AI is reshaping the power industry, driving an unprecedented surge in demand from data centers. In this newsletter, we explore how AI-driven workloads are affecting power grids and equipment demand. Based on insights from Morgan Stanley’s and Goldman Sachs’s reports, as well as recent Reuters news, we’ve highlighted the key challenges and opportunities emerging in the power sector.

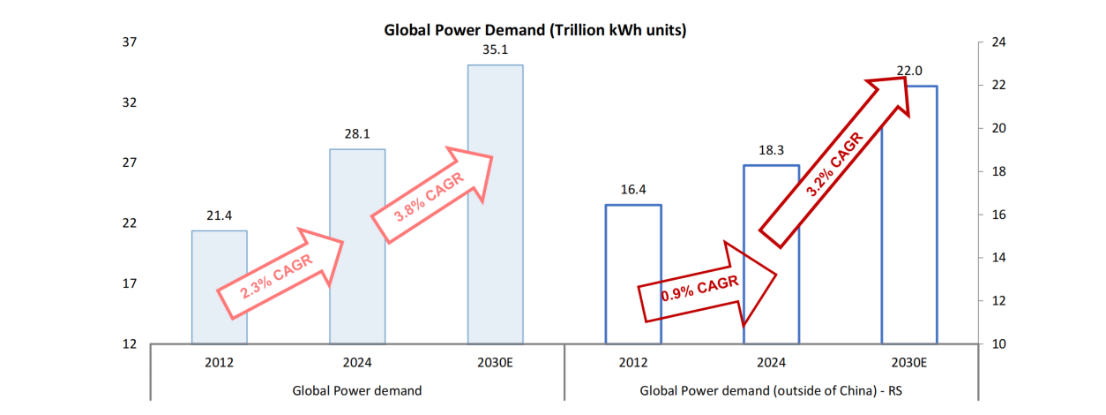

Global electricity demand is on the rise, and projections show a 10% increase in demand since 2024. The need for power is escalating due to multiple factors, including AI's growing energy appetite, with global power demand set to reach 35.1 trillion kWh by 2030.

As shown in the chart, global demand for electricity is growing steadily, with significant increases expected in regions like Asia, Europe, and North America.

Source: Morgan Stanley, “Power: Changing Face with AI”, Page 3.

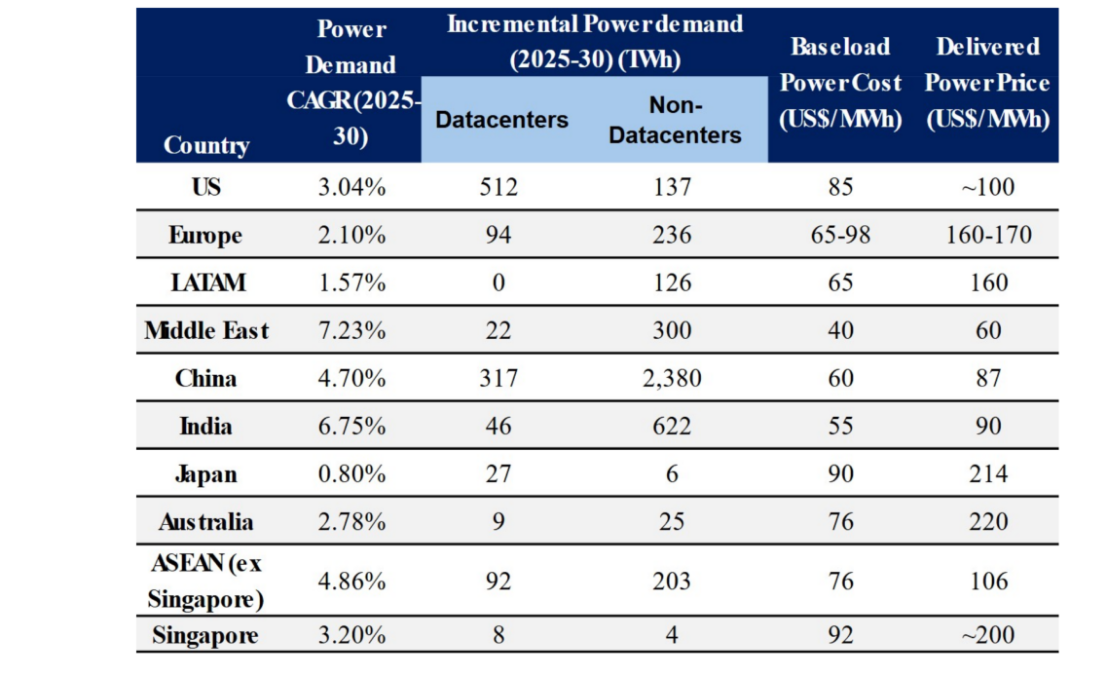

Source: Morgan Stanley, “Power: Changing Face with AI”, Page 6.

AI is reshaping industries, and its impact on power demand is undeniable. Data centers, the backbone of AI, currently account for 2% of global power consumption. This number is set to drive 20% of the total incremental power demand, potentially accounting for 5% of global demand by 2030.

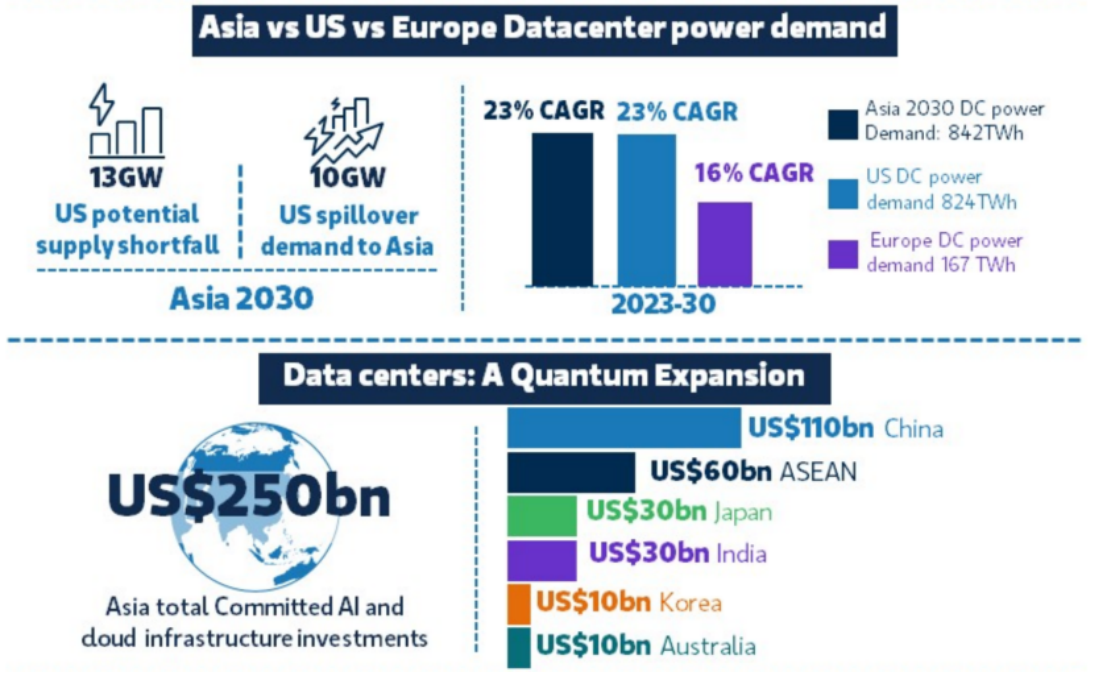

According to Morgan Stanley’s “Power: Changing Face with AI” report, electricity consumption in U.S. and Asia-based data centers is expected to grow at a 23% CAGR, with Europe following at 16% CAGR. Global investments in AI and cloud computing are projected to hit $250 billion by 2030.

Source: Morgan Stanley, “Power: Changing Face with AI”, Page 21.

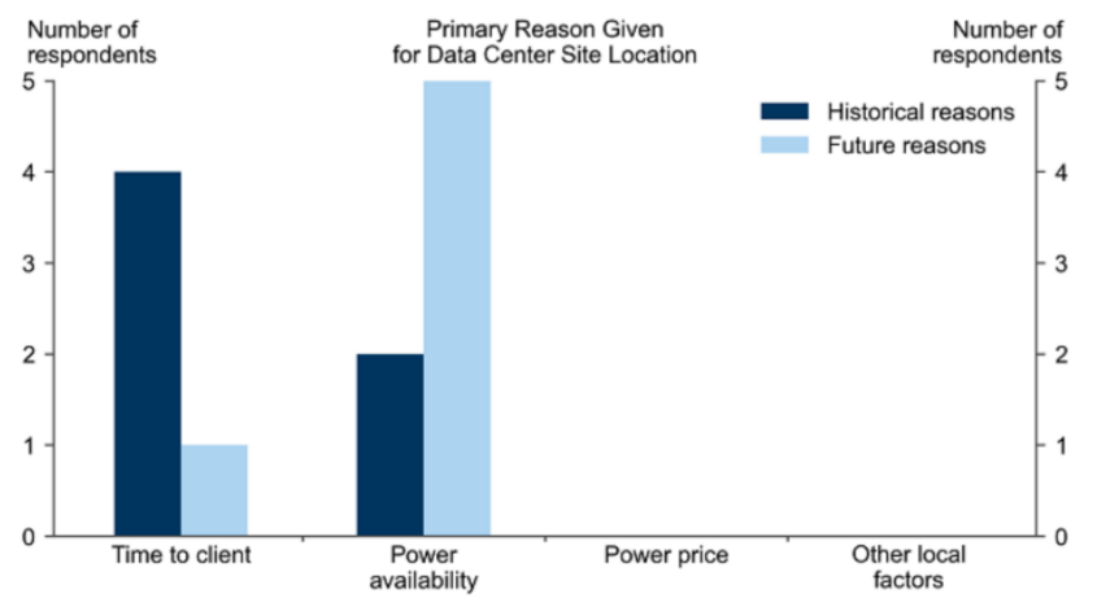

As AI workloads diversify, power availability has become the most critical factor in data center site selection.

Emerging Trend:

High power demand + Risk Management: Data centers are more concerned with power stability and supply control rather than “low latency.”

According to Goldman Sachs, the majority of surveyed engineers believe “Power Availability” will be the top site selection factor in the next 5 years.

Source: Goldman Sachs, “Where Will Data Centers Go?”, Page 8.

One of the key takeaways from recent reports is the emergence of a Green Reliability Premium. While renewable energy sources like wind and solar have lower levelized costs of energy, their intermittent nature requires supplementary storage or backup solutions to meet the 24/7 power demands of data centers. This makes nuclear and natural gas critical components of the energy mix, as they offer consistent power delivery, albeit at a higher cost.

Goldman Sachs forecasts that nuclear energy, particularly small modular reactors (SMRs), will play an increasingly vital role in supplying low-carbon, round-the-clock power solutions to data centers. The investment in SMRs is expected to ramp up significantly in the coming decade, with large-scale deployment possible by the early 2030s.

As data centers, power plants, renewable energy installations, manufacturing, and electric vehicle (EV) infrastructure simultaneously drive up electricity demand, the power grid is facing unprecedented challenges. Investments in transmission and distribution (T&D) networks are urgently needed to accommodate this growth.

According to a Reuters report, “U.S. grid investments are on the rise as power demand grows and network operators seek to upgrade and expand grid infrastructure to accommodate clean power and strengthen grid reliability.” The report highlights that transmission investments will increase by approximately 23% from 2025 to 2030.

Meanwhile, another Reuters report reveals that demand for key grid equipment (such as transformers, high-voltage equipment, and switchgear) has surged. Equipment manufacturers are committing significant investments in the U.S. to address supply shortages.

According to Morgan Stanley, as a result of supply chain tightness, many key grid components now face long lead times (3-5 years) and price hikes (over 30% since 2019).

On the macro investment front, global grid modernization investments (CAPEX) are already substantial. For 2024, global grid upgrade investments are estimated at USD 400 billion, which is expected to reach USD 600 billion by 2030.

References:

1. Morgan Stanley, "Power: Changing Face with AI" November 27, 2025.

2. Goldman Sachs, "Where Will Data Centers Go" September 5, 2025.

3. Reuters, "Grid Equipment Makers Invest in U.S. to Ease Supply Shortages" December 2, 2025. (https://www.reuters.com/business/energy/grid-equipment-makers-invest-us-ease-supply-shortage--reeii-2025-12-02)

4. Reuters, "U.S. Grid Investors Focus on Demand Hotspots in Planning Shift" October 20, 2025. (https://www.reuters.com/business/energy/us-grid-investors-focus-demand-hotspots-planning-shift--reeii-2025-10-20)